Resources

Trading Tools

At ICM we continuously strive to offer services that support you when trading with us. That includes our Pip Calculator which helps you to calculate the value of a pip depending on the currency pair and the lot size of your transaction.

You will also find a Pivot Calculator which is simple to use and designed to calculate pivot points in only a few seconds. In addition, you can access our Economic Calendar to help you to track the occurrence of market-moving events. You can use the Trading Signals feature on the MT4 platform which helps you subscribe to the signal feeds of other traders also using the system.

Economic Calendar

VPS hosting for forex trading

Our Virtual Private Server (VPS) is available for all new and existing clients who maintain a minimum balance of $4,000 or equivalent in EUR, GBP or SGD in their account. It allows expert advisors to be installed and operate without interruption 24 hours a day, whenever the markets are open. This is provided in partnership with Beeks FX, a global leader in VPS solutions. If you are a forex trader and would like access to one of the fastest VPS services in the industry, then please complete the short form below to find out more.

Key Features

Specifications

What is a pip?

A pip is the minimum fluctuation of the instrument being priced. At ICM we have introduced 5 digit quotes to allow our clients to benefit from smaller price increments and moves in the market. For instance, Instead of quoting prices with 4 digits, i.e EURUSD 1.3151/1.3153, we quote the pair at a lower spread of 1.3 as 1.31508/1.31524.

What is a lot?

A forex lot is the amount of currency you buy or sell. For example, if you wish to trade $100,000, this is the size of the trade. A forex lot is a representation of trade size in a different format. In this example, a standard lot would represent 100,000 of any currency.

EUR 100,000 = 1 standard lot Euro

ICM offers leverage of 1:200. However, while you can earn profits by using leverage, it can also work against investors. For example, if the currency underlying one of your trades moves against you, leverage will greatly amplify the potential losses. To help reduce the chances of such a scenario occurring, forex traders typically implement a trading style that includes the use of stop and limit orders.

To assist with accuracy, please ensure the numbers entered are in the required format and include the correct amount of digits. For example, if EUR/USD is quoted at 5 digits instead of 4.

Incorrect format: 1.3151/1.3153

Correct format: 1.31508/1.31524

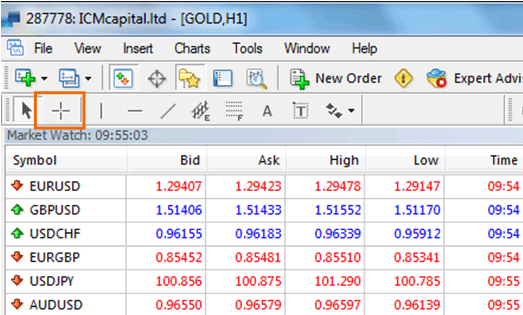

In order to calculate the pivot point you must take the Open, High, Low and Close price located in the MetaTrader 4 platform, by using the 'Crosshair' (the + sign in the top left hand corner) and moving it over the chart.

What is a trailing stop?

A trailing stop causes the level of the stop loss to trail the price level of a buy or sell position. Using a specified algorithm, a trailing stop enables traders to maintain their open position and continue to achieve positive results as long as the price moves in their favoured direction. Once trailing stops have been fixed they do not have to be altered manually, unlike a stop loss.

Will the trailing stop work when I am offline?

When a trailing stop order is being placed, ensure the MetaTrader 4 client terminal is running and that your device is connected to the internet, as it will only remain active when you are online. Once the trading platform is closed, your trailing stop order will be deactivated, and your stop loss order will remain active if placed before the trailing stop.

If you are new to forex trading, micro lots are an ideal way for you to enter a fast-moving and exciting market with a daily turnover of over $5 trillion a day. In forex trading, the minimum contract size for a micro account is 0.01 of a lot, which is equal to 1,000 units of the base currency.

At ICM, every trader is treated equally irrespective of their deposit size, and we offer this type of trading to all clients, while also being available on both our demo and live MT4 platforms.

We are always looking for new ways to improve your trading environment and offer the highest standards of service. If you have any questions please feel free to get in touch with our Client Services team.

Key Features

How to access trading signals

Becoming a signal provider

Advanced ICM traders also have the option to use trading signals. Simply register here as a ‘Seller’ by completing the registration form. Once complete, you can sell signals to thousands of subscribers around the world. Please note, while there are no registration costs involved, it will take 30 days for your trade history to be reviewed by MetaQuotes before a fee can be added to your service.

Please read our helpful user guide on becoming a signal provider: User guide

Are trading signals secure?

The MetaQuotes software ensures each trade features a digital signature that prevents the trade from being copied incorrectly. Trades triggered by a provider’s signal are duplicated on the subscriber’s account to reflect the money management rules used by the signal provider. Signal providers are paid a fixed monthly subscription fee.

How do I choose a signal provider?

Generally, if a signal provider has performed 100 or more trades it can be viewed as an active account. Clients should be aware of the drawdown percentage, with anything lower than 30% thought to be ideal.

Following signal providers with a steady growth rate is also advisable. However, if the growth rate reaches a high point in a short space of time, they could be trading in a high-risk manner. Finally, you may find that paid signals are more reliable in the long run. If you choose to follow a signal provider who charges a fee to receive their signal, you can have confidence the signal provider has used the 30 day trial period and has subsequently been verified by MetaQuotes, a process all traders must go through if they wish to charge for their signals.

How can I manage my risk with trading signals?

To manage risks treat each one as an individual trade and ensure parameters are also set to mitigate potential risk. Develop a strategy to decide how much of your account will be dedicated to each signal provider. Also ensure the strategy contains an exit plan along with rules of when you will stop tracking each signal.

Disclaimer

MetaQuotes Software Corp. is a respected third party software development company however the information provided should not be considered as trading advice. ICM provides the opportunity for clients to follow trading signals to support clients in their trades, however each Signal Provider should be independently evaluated. ICM will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

cAlgo (cTrader Automate) is an algorithmic trading solution natively integrated with cTrader, working seamlessly alongside all other functionalities of the platform. Traders can build automated trading robots and custom indicators in C# language using the cTrader API, all built from a platform equipped with the tools needed to effectively back test and optimise trading strategies.

ICM Capital Limited (UK) is regulated and authorised by Financial Conduct Authority (FCA) registration number: 520965.

ICM Capital Limited (UK) is regulated and authorised by Financial Conduct Authority (FCA) registration number: 520965. ICM Limited (Abu Dhabi, UAE) is regulated and authorised by the Abu Dhabi Global Markets (ADGM) Financial Services Regulatory Authority (FSRA) registration number: 210045.

ICM Limited (Abu Dhabi, UAE) is regulated and authorised by the Abu Dhabi Global Markets (ADGM) Financial Services Regulatory Authority (FSRA) registration number: 210045. ICM Capital Limited (MU) is regulated and authorised by Financial Services Commission of Mauritius under license number: C118023357.

ICM Capital Limited (MU) is regulated and authorised by Financial Services Commission of Mauritius under license number: C118023357. ICM Capital (Labuan) Limited is regulated and authorised by Financial Services Authority of Labuan under license number: MB/18/0029.

ICM Capital (Labuan) Limited is regulated and authorised by Financial Services Authority of Labuan under license number: MB/18/0029. ICM Capital LLC (VC) is registered by the Financial Services Authority of Saint Vincent and the Grenadines under number: 1853 LLC 2022.

ICM Capital LLC (VC) is registered by the Financial Services Authority of Saint Vincent and the Grenadines under number: 1853 LLC 2022. ICM Capital SA (Pty) Ltd is a licensed Financial Services Provider, regulated and authorised by the Financial Sector Conduct Authority (FSCA) of South Africa FSP: 53234.

ICM Capital SA (Pty) Ltd is a licensed Financial Services Provider, regulated and authorised by the Financial Sector Conduct Authority (FSCA) of South Africa FSP: 53234. ICM House AG (Zurich, Switzerland) is member of the ARIF (Association Romande des Intermediaries Financiers) under the registration number CHE-497.911.976.

ICM House AG (Zurich, Switzerland) is member of the ARIF (Association Romande des Intermediaries Financiers) under the registration number CHE-497.911.976.